Is Plaid Safe? Evaluating the Security of Financial Data Aggregators

Bisma Farrukh

You may encounter services like Plaid that connect your bank accounts to various apps and platforms as you manage your finances online, but have you ever wondered about the safety of sharing your sensitive financial data through these third-party aggregators? In an era of increasing cyber threats, it’s crucial to understand the security measures protecting your personal information. This article will examine is plaid safe, its safety protocols, evaluate potential risks, and provide you with the knowledge to make informed decisions about using financial data aggregators. By the end, you’ll see whether Plaid can be trusted with your valuable financial data.

Table of Contents

What is Plaid and How Does It Work?

Plaid is a financial technology company that secures the connection between your bank and various financial apps. The platform employs bank-level encryption to protect your sensitive data. Connecting an app using Plaid securely retrieves your financial information without storing your login credentials.

Plaid operates using a set of APIs that facilitate secure data transfer between financial institutions and third-party applications.

Plaid’s API can gather information on balances, transactions, and other account details. The company also provides authentication and identity verification features that enhance user security.

The company adheres to strict security protocols and is regularly audited. While no system is entirely foolproof, Plaid’s robust security measures make it a legitimate and widely trusted service in the fintech industry.

- The first step is to create a Plaid account and connect it to your bank account.

- You must enter your bank account login information to establish this link.

- Plaid will then use this information to confirm account ownership.

- Once verified, Plaid will start collecting account information from your bank account, including balances, transactions, and other important details.

- Plaid uses Open Authorization (OAuth), an industry standard for user authentication and data security.

- With OAuth, you can grant access to specific data without giving full control over third-party applications.

- When Plaid requests your data, it checks the application credentials against your authorizations.

- Once approved, the third-party app from Plaid will issue a variable access token containing the desired data.

Is Plaid safe to use?

Yes, its safe to use as it secures financial data aggregator offers numerous advantages. Plaid streamlines connecting your bank accounts to various apps, saving you time and hassle. It’s trusted by major financial institutions and tech companies alike.

Using Plaid gives you access to various financial services and tools that can help you better manage your money and make informed decisions. Plaid has established itself as a trusted name in the industry, with millions of users and partnerships with major financial institutions.

Potential Security Risks of Plaid

While Plaid is generally considered secure, it’s crucial to understand potential vulnerabilities. Like any financial technology, Plaid faces data breaches and unauthorized access risks. Its practice of storing login credentials raises concerns. Additionally, it becomes complex when considering third-party integrations and the vast amount of sensitive financial data it handles. Users should weigh these risks against the convenience Plaid offers.

How Does Plaid Keep Your Data Safe?

- The company employs robust encryption and security protocols to safeguard your financial information.

- Plaid uses bank-level encryption to protect data in transit and at rest. They also implement strict access controls and regular security audits, which is why major financial institutions consider Plaid safe.

- Plaid maintains compliance with industry standards like SOC 2 and ISO 27001.

- Additionally, if you want to know “is Plaid legit”, then Plaid is legit and regulated by monetary authorities, providing an extra layer of user protection.

- Plaid utilizes tokenization technology, encryption, and secure storage to enhance data security. Tokenization involves replacing sensitive data with a specific token, which can be used as a substitute for bank login credentials. This means that even if someone gains access to the token, they won’t be able to use it to access the real bank account.

What Information Can Plaid See?

It’s crucial to understand the scope of data they can access. Plaid, a legitimate financial data aggregator, can see your account balances, transaction history, and personal information like name and address. However, the specific data visible depends on the permissions granted by you and the connected financial institution.

It’s important to note that they cannot see your login credentials directly. Instead, they use encrypted tokens to access your financial data, enhancing security.

How do you manage your bank information while using Plaid?

To ensure Plaid is secure and safe to use, take these steps:

- Regularly review connected apps in your bank’s settings.

- Use strong, unique passwords for financial accounts.

- Enable two-factor authentication when available.

- Monitor account activity for any suspicious transactions.

Remember, while Plaid is legit, it’s crucial to stay vigilant. By following these practices, you can confidently use Plaid-powered services to control your financial data.

How Plaid Handle Your Information?

When considering whether Plaid is safe to use, it’s crucial to understand its data handling practices. Plaid employs bank-level encryption to protect your financial information, ensuring your sensitive data remains secure. The company is committed to transparency, clearly outlining how it collects, uses, and stores your data in its privacy policy. Plaid’s legitimacy and safety measures ultimately make it a trusted option for many financial institutions and consumers.

What Apps Use Plaid?

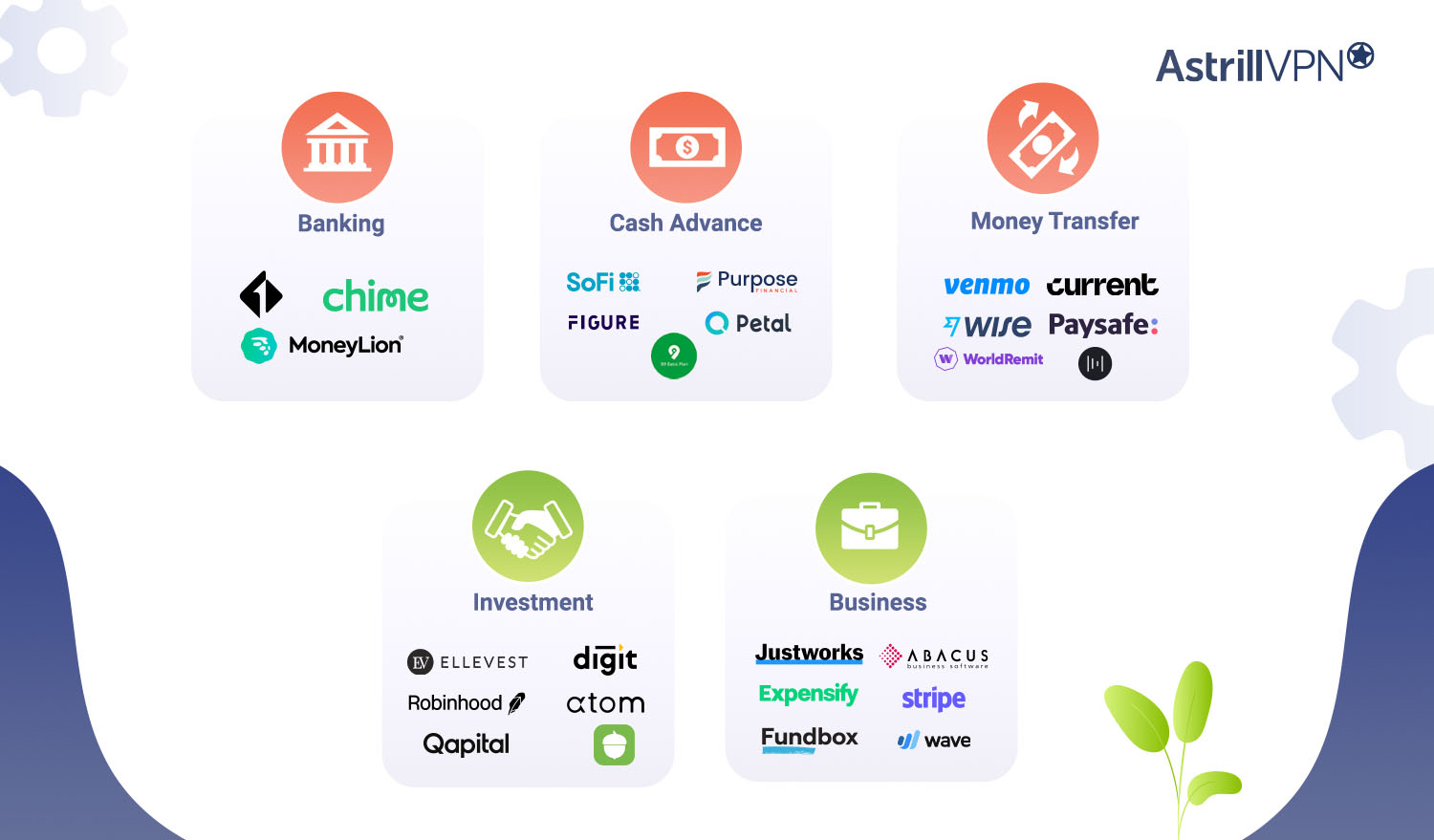

Thousands of popular apps and services utilize plaid’s secure financial data aggregation services. It’s important to know which apps rely on this technology. Many budgeting tools, investment platforms, and digital banks integrate Plaid to connect your accounts securely.

Major fintech companies like Venmo, Robinhood, and Acorns trust Plaid’s infrastructure. Even traditional banks use Plaid to link accounts. Understanding which apps use Plaid can help you evaluate if Plaid is secure for your needs.

| App Type | Examples |

| Banking | FirstTech Chime MoneyLion |

| Cash Advance | SoFi Petal B9 Figure Purpose Financial |

| Money Transfer | Wise Venmo Metal Paysafe WorldRemit Current |

| Investment | Acorns Robinhood Digit Atom Qapital Ellevest |

| Business | Stripe Abacus Wave Fundbox Justworks Expensify |

What to Do If a Chase Account Stops Linking to Plaid?

If your Chase account suddenly stops connecting to Plaid, don’t panic. This issue is usually temporary and can be resolved.

- First, verify your app’s legitimacy to ensure Plaid is secure and safe.

- Then, try unlinking and relinking your account.

- If that doesn’t work, check for Chase security updates or temporary outages.

- You may need to update your login credentials or clear your browser cache.

- Yes, but if problems persist, contact their customer support for personalized assistance.

Why does Plaid need my bank password?

This question often arises when users are asked to provide their bank login credentials. Plaid requires your password to connect to your financial institution and retrieve account information securely. This process, known as “screen scraping,” allows Plaid to aggregate your financial data safely.

Tokenization involves exchanging your bank login credentials for a token, which is a unique identifier used to access your account. This token is securely stored and utilized to retrieve your financial data on your behalf. Tokenization is a widely accepted standard in the banking industry and is considered a secure authentication method. For instance, other financial platforms like PayPal and Venmo also use tokenization to access bank account information. It’s important to note that Plaid’s use of tokenization is subject to strict security protocols.

Can I unlink my bank account from Plaid?

Yes, you can unlink your bank account from Plaid. While Plaid is generally secure, you may want to disconnect for privacy reasons.

- Log into your financial app and locate the ‘Connected Accounts’ or ‘Settings’ section to do this.

- Find the option to remove Plaid access and follow the prompts.

- Remember that unlinking doesn’t automatically delete your data.

- Contact Plaid directly to request data deletion for complete peace of mind.

Why doesn’t Plaid work with Wells Fargo?

The relationship between Plaid and Wells Fargo has been complex. Wells Fargo has expressed concerns about data sharing practices, which has led to intermittent connectivity issues. Despite Plaid being widely considered secure, Wells Fargo has prioritized developing its API for third-party access. Plaid is not compatible with Wells Fargo, as they have different methods of exchanging data. In 2019, Wells Fargo announced plans to change its terms of service to prevent external investment aggregators like Plaid from accessing its customers’ financial data. This decision surprised many in the industry, as banks and financial technology companies have historically shared a significant amount of data.

Following Wells Fargo’s lead, some other banks have also limited customer data access, while many continue to support data sharing through tools such as Plaid. Plaid chose not to circumvent Wells Fargo’s restrictions, citing its commitment to operating safely and transparently.

Wells Fargo’s history of significant data breaches and other security risks may have influenced the bank’s lack of support. The bank has experienced numerous data breaches in recent years, raising concerns about the security of its customers’ financial information. It’s important to note that even though the reasons for the bank’s decision are unknown, Wells Fargo may have valid reasons for restricting access to customer data. Every bank should prioritize protecting consumer privacy and data security, and Wells Fargo may have asserted that the risks are too high.

This situation highlights ongoing debates about whether financial data aggregators like Plaid are legit and how to balance innovation with security in banking.

Alternatives of Plaid

Several options exist for those seeking alternatives.

- Yodlee is a leading platform that offers data collection and analytics services to financial institutions and IT companies worldwide. It aims to assist businesses and individuals in making informed financial decisions and has established a standard for data security and transparency in the industry.

- MX is a fintech company focused on providing data collection and analytics services to financial institutions and their clients. The platform offers customizable APIs to meet the requirements of various companies and supports APIs that integrate with multiple financial institutions. MX has built a reputation as a dependable and secure platform.

- Finicity is an advanced data collection and analytics platform catering to the needs of financial institutions and the fintech industry. The platform facilitates a wide range of financial transactions, from credit card issuers to banks and other financial institutions. Finicity has garnered numerous awards for its industry-leading security and privacy standards.

- Tink is a European-based fintech company that provides financial planning, analytics, and data collection services to individuals and businesses. For its security and data protection measures, Tink is known as one of the safest fintech companies and has received numerous industry accolades and awards.

Conclusion

Considering whether to use Plaid or similar financial data aggregators, carefully weigh the convenience against potential security risks. While Plaid employs robust encryption and security measures, sharing login credentials carries some inherent risks. Evaluate your comfort level with third-party access to financial data. Stay informed about Plaid’s evolving privacy policies and security practices. Consider alternatives like manually entering account information when possible. Ultimately, the decision comes down to your risk tolerance and need for streamlined financial services. By understanding how Plaid works and taking precautions, you can make an informed choice about using this technology to manage your finances.

Frequently Asked Questions:

Yes, Plaid is a legitimate financial data aggregator trusted by many institutions. PayPal does use Plaid for account linking. Plaid requests bank logins to securely connect accounts, but cannot withdraw money or charge fees. While using Plaid is typically free for consumers, some apps may have associated costs.

Yes, Plaid is generally free for end-users. However, businesses and developers integrating Plaid’s services may incur costs.

Many financial institutions and tech companies trust Plaid. It employs robust security measures to protect user data.

No, Plaid cannot directly withdraw money from your accounts. Yes, it’s considered secure, but always exercise caution with financial data.

No comments were posted yet