Cash App Scams: How to Avoid Them and Stay Secure?

Bisma Farrukh

Cash App is the popular mobile payment application that has revolutionized the way we send and receive money. While Cash App offers simplicity and ease in managing finances, it has also attracted the attention of scammers looking to exploit unsuspecting users.

In this guide, we’ve discussed all about how can you get scammed on Cash app, the types, and how you can protect yourself from it. Follow this guide thoroughly to protect yourself from scammers.

Table of Contents

What is Cash App?

Cash App is a mobile payment application developed by Square Inc. that has gained widespread popularity for its simplicity and convenience in transferring money and managing finances.

Cash App is a digital wallet allowing users to send and receive money from friends, family, or anyone in their contact list. It provides a hassle-free solution for splitting bills, repaying loans, or sharing expenses without the need for physical cash or checks.

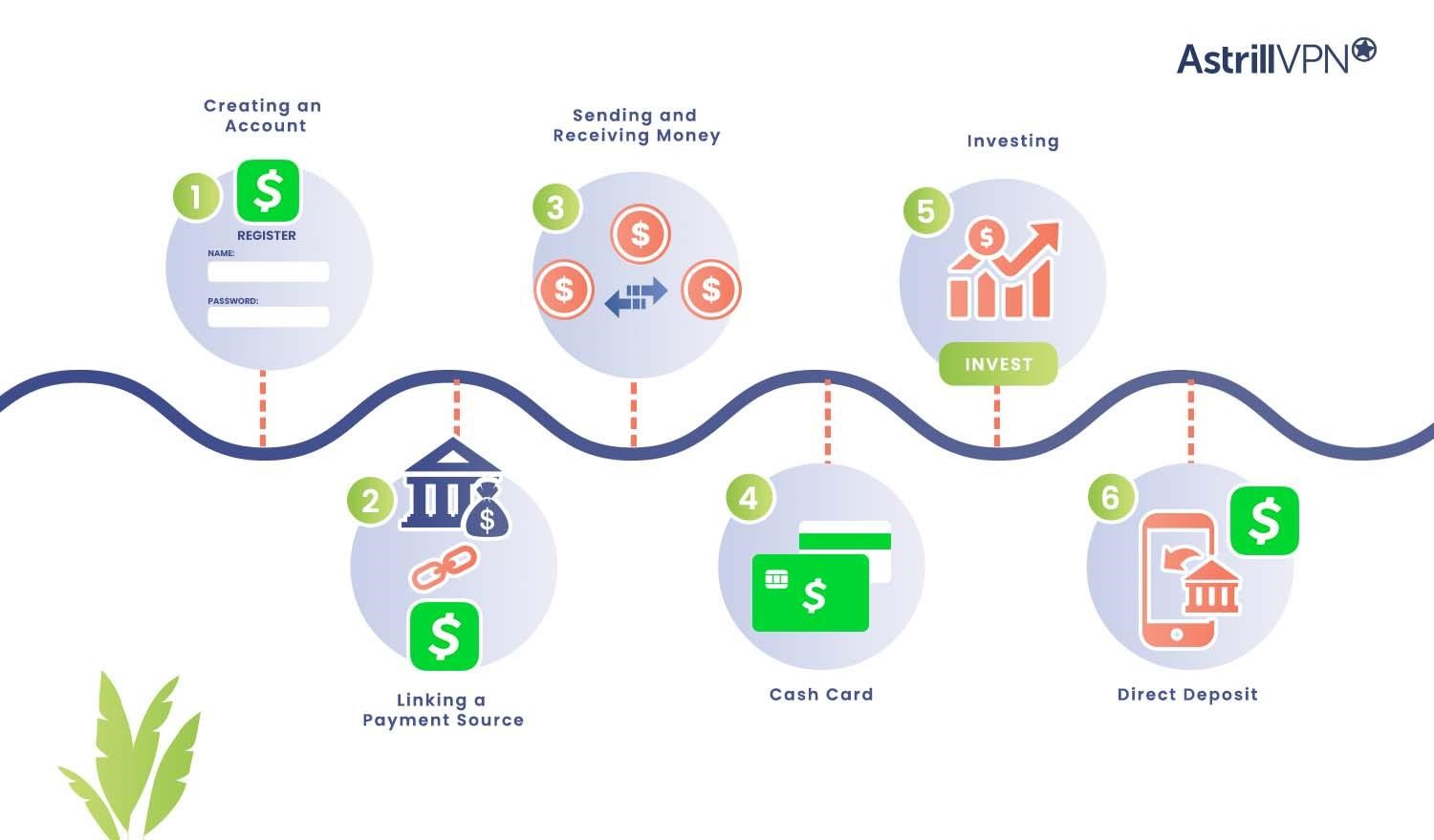

How does Cash App work?

Cash App is a straightforward and user-friendly platform that facilitates various financial transactions. Here’s how Cash App works:

- Creating an Account: To start with Cash App, users need to download the app from the App Store or Google Play Store and create an account. Registration typically involves providing a valid phone number or email address and other verification steps.

- Linking a Payment Source: Users can connect their Cash App account to a bank, debit, or credit card account. This linked payment source allows them to add funds to their Cash App balance, send money, and make purchases.

- Sending and Receiving Money: Cash App users can easily send money to others by entering the recipient’s username, phone number, or email address. Once a payment is initiated, the recipient receives a notification and can accept the funds. Money is transferred instantly between Cash App accounts.

- Cash Card: Users can request a physical Cash Card linked to their Cash App balance. This card can be used for making purchases at brick-and-mortar stores, withdrawing cash from ATMs, and taking advantage of cashback rewards.

- Investing: Cash App provides a platform for investing in stocks and cryptocurrencies. Users can buy, sell, and hold shares of publicly traded companies or invest in Bitcoin and other cryptocurrencies directly within the app.

- Direct Deposit: Cash App allows users to set up direct deposit, receiving paychecks, government benefits, and tax refunds directly into their Cash App balance.

Cash App’s safety features

The buzz about the Cash App scams has intrigued people so much that now the masses have asked, “Is Cash Appp a scam?”. That happens when people lose their trust in things and consider something unsafe or a scam.

Cash App strongly emphasizes the safety and security of its users’ financial transactions and personal information. To ensure a secure and trustworthy experience, the platform has implemented several key safety features:

1. Encryption

Cash App employs robust PCI-DSS level 1 certification encryption technology to protect user data and financial information. All data transmitted between the app and its servers is encrypted, making it extremely difficult for unauthorized parties to access or intercept sensitive information.

2. Two-Factor Authentication (2FA

To enhance account security, Cash App allows users to enable two-factor authentication (2FA). This additional layer of security requires users to enter a one-time code sent to their registered phone number or email address when logging in or performing sensitive actions like sending money or changing account settings.

3. Account Verification

Cash App encourages users to verify their accounts by providing personal information, such as their full name, date of birth, and Social Security Number. This verification process helps prevent fraudulent activity and ensures that users are who they claim to be.

4. Cash Card Security

It has additional security features for users who opt for the Cash Card. Users can customize their Cash Card by adding their signature, which makes it more secure and less susceptible to unauthorized use. Moreover, the Cash Card can be easily deactivated from the app if lost or stolen.

5. In-App Security Alerts

Cash App provides real-time security alerts to notify users of suspicious or unauthorized activity on their accounts. These alerts help users stay informed and immediately act if they notice unusual transactions.

6. Fraud Protection

Cash App offers a comprehensive fraud protection policy. If a user falls victim to a scam or unauthorized transaction, Cash App provides a process for reporting the incident and seeking resolution.

What Are Some Common Cash App Scams?

1. Cash App Bitcoin Scams

Cash App Bitcoin scams involve fraudsters posing as sellers or investors offering Bitcoin at a discounted rate or promising significant investment returns. Victims are convinced to send money via Cash App with the promise of receiving Bitcoin, but they never receive any cryptocurrency. These scams prey on individuals looking to invest in cryptocurrencies and can result in substantial financial losses.

Be wary of unsolicited offers of Bitcoin investments, promises of guaranteed returns, and requests for Cash App payments from unknown individuals or unverified sources.

2. Cash App Flip Scam

In Flip scams, the scammers promise to multiply the money you send. Scammers ask you to send them a certain sum, claiming they’ll “flip” it and return a larger amount. However, the scammers vanish after you send the money, leaving you with financial losses.

These scams appeal to users seeking quick and easy money. Offers that sound too good to be true, requests for upfront payments, and pressure to act quickly should raise suspicion.

3. Cash App Scams on Facebook

Scammers use Facebook to create fake profiles or groups, impersonating Cash App customer support or offering Cash App-related services. You’ll notice most cash app scams on Facebook Messenger, where scammers contact Cash App users.

They may request personal information login credentials or payment to resolve issues or unlock features. These scams leverage the trust people have in social media platforms.

4. Instagram Cash App Scams

Instagram scammers use tactics, including fake profiles, giveaways, and sponsored posts, to trick users into sending money to fraudulent accounts. These scams may promise Cash App bonuses, free money, or exclusive offers. Instagram’s visual nature makes it a fertile ground for enticing scams.

5. Posing as Cash App support

Scammers impersonate Cash App support teams through various channels, including email, phone calls, and fake websites. They often claim a problem with your account and request your login credentials, personal information, or payment to resolve the issue. Legitimate customer support teams never ask for such sensitive information.

6. Offering expensive goods

Scammers on Cash App sometimes pose as legitimate sellers offering high-value goods at meager prices. They might advertise items like electronics, luxury fashion, or even vehicles for sale.

These enticing offers are designed to lure in unsuspecting buyers. However, the scammer disappears after you send the payment, leaving you without the promised product. To protect yourself, always be cautious when purchasing items from individuals or sources you don’t know and trust.

Research the seller, ask for additional information or photos, and consider using a secure platform for online transactions, especially for high-value purchases.

7. Random deposits

Another tactic scammers use is sending random deposits to Cash App users. They claim these deposits were sent by mistake and request you refund the money. In reality, the deposits are often fraudulent, and if you return the funds, you may lose money from your account.

To avoid this scam, never send money back to someone you don’t know who claims to have sent you an accidental payment. Instead, report the incident to Cash App’s customer support.

8. Claim your prize

Scammers often send messages or notifications claiming you’ve won a substantial cash prize or a valuable gift. To claim your prize, they ask for personal information, bank account details, or a payment to cover taxes or fees.

The promised prize doesn’t exist in these scenarios, and the scammer’s goal is to steal your money or identity. Always be skeptical of unsolicited prize notifications, and never share personal or financial information with unknown sources.

8. SSN request

Some scammers may go to great lengths to impersonate Cash App support, claiming they need your Social Security Number (SSN) to verify your identity or resolve account issues. Legitimate support teams from Cash App or any reputable company would never request your whole SSN via email, phone, or chat.

Sharing your SSN with scammers can lead to identity theft and financial fraud. Always verify the authenticity of support requests and refrain from providing sensitive information unless you are certain you are dealing with a legitimate entity.

10. Government relief payments

Scammers often take advantage of moments of crisis or economic uncertainty, such as during the COVID-19 pandemic, by sending fake messages or emails claiming they can help you access government relief payments or stimulus funds through Cash App.

They may request personal information, bank details, or a payment to expedite the process. It’s important to remember that government relief payments are typically distributed through official channels, and Cash App does not play a role in distributing them.

11. Fake refunds

In this scam, fraudsters may contact you, posing as Cash App support, and claim that you are eligible for a refund due to an issue with a recent transaction. They will ask for your account information or request a payment to initiate the refund.

Legitimate Cash App support teams do not initiate contact with users in this manner. Be cautious and verify the legitimacy of such refund claims through the official Cash App support channels.

12. Bad Romance

Online dating scams can also occur through Cash App. Scammers may engage in romantic conversations with individuals, gain their trust, and eventually request money for various reasons, such as medical emergencies or travel expenses to meet in person.

Be cautious when engaging in online relationships and avoid sending money to someone you have yet to meet in person, especially if they request it through Cash App.

13. #CashAppFridays

While #CashAppFridays is a legitimate promotion where Cash App users can win money, scammers sometimes exploit this hashtag to impersonate Cash App giveaways. They may create fake accounts or post fake giveaway announcements, asking users to send money to participate or claiming they have won a prize.

14. Phishing emails

Phishing emails are a common tactic scammers use to trick users into revealing their Cash App login credentials or other sensitive information. These emails often appear as official Cash App communication, asking recipients to click on a link and log in to their accounts. However, the link directs users to a fake website to steal their login information.

15. Fake security alerts

Scammers may send fake security alerts or notifications claiming that your Cash App account has been compromised or locked. They will then request personal information or ask you to click a link to resolve the issue.

Legitimate security alerts from Cash App are typically delivered within the app, not through external messages. To verify the authenticity of security alerts, access your Cash App account directly through the official app and review any notifications there.

How To Avoid Cash App Scams

Avoiding Cash App scams is essential to protect your financial security and personal information. Here are some crucial tips to help you avoid falling victim to these scams:

1. Download the Official App

Always download Cash App from official sources, such as the App Store for iOS devices or Google Play Store for Android. Avoid third-party websites or app stores, as they may offer compromised versions.

2. Enable Two-Factor Authentication (2FA)

Activate 2FA within your Cash App settings. This security feature adds an extra layer of protection by requiring a one-time code to be sent to your registered phone number or email whenever you log in or perform sensitive actions.

3. Verify Recipients

Before sending money, double-check the recipient’s information. Verify usernames, phone numbers, or email addresses to ensure accuracy and avoid sending funds to the wrong person or a scammer.

4. Caution with Unsolicited Requests

Be highly cautious of unsolicited requests for money or personal information. Scammers often initiate contact through unexpected messages, emails, or phone calls.

5. Guard Sensitive Information

Never share sensitive information like your Social Security Number (SSN), Cash App PIN, banking details, or login credentials with anyone, especially if they request this information through unsolicited messages or calls.

6. Be Cautious with Investments

Approach investment offers with skepticism, especially those promising guaranteed returns or quick riches. Verify the legitimacy of investment opportunities and research before committing funds.

7. Verify Support Channels

When seeking assistance from Cash App support, verify their authenticity. Cash App’s official Twitter account has a blue checkmark indicating it’s verified. Avoid responding to unsolicited messages claiming to be from support.

8. Avoid Cash App Flip Promotions

Refrain from engaging in “Cash App Flip” promotions, where individuals promise to multiply your money in exchange for an upfront fee. These offers are almost always scams.

9. Use Cash App for Personal Transactions

While Cash App can be used for business purposes, it’s generally safer for personal transactions with people you know and trust.

What To Do if You Get Scammed

Experiencing a scam can be distressing, but taking immediate action is crucial to minimize the damage and increase the chances of recovering your funds. If you believe you have fallen victim to a Cash App scam, here are the steps you should take:

1. Contact Cash App Support

- Open your Cash App and navigate to your profile.

- Scroll down and select “Support.”

- Choose the issue that best describes your situation, such as “Something Else.”

- Provide a detailed description of what happened, including the date, time, and any communication with the scammer.

- Submit your request for assistance.

2. Report the Incident to Law Enforcement

Contact your local law enforcement agency or report the scam to your country’s appropriate agency for internet fraud or cybercrime. Provide them with all the details of the scam, any relevant screenshots or emails, and any information you have about the scammer.

3. Contact Your Bank or Card Issuer

If you provided your bank account or card information to the scammer, contact your bank or card issuer immediately. Explain the situation and ask if they can assist with blocking or reversing any unauthorized transactions.

4. Change Passwords and Enhance Security

Change your Cash App PIN and password immediately to prevent further unauthorized access.

Enable two-factor authentication (2FA) for added security.

5. Monitor Your Accounts

Regularly check your Cash App account, bank, and credit card statements for unauthorized or suspicious transactions. Report any additional unauthorized activity promptly.

How AstrillVPN can Protect You From Scams?

Some scammers may use location-based scams, offering services or opportunities only to users from specific regions. AstrillVPN can connect to servers in different countries, allowing you to access Cash App from regions where it might not typically be available and avoiding such scams.

AstrillVPN hides your actual IP address and replaces it with the IP address of the VPN server. This makes it more difficult for scammers to determine your real location or identity. It can help protect your personal information, making it less likely for scammers to target you based on your location.

When using Cash App on public Wi-Fi networks, you may be at risk of data interception by cybercriminals. AstrillVPN can secure your connection, ensuring your data remains encrypted and protected even on untrusted networks.

AstrillVPN can also help protect against phishing attacks by preventing websites from seeing your actual location. Some phishing attempts are region-specific, and by using AstrillVPN, you can access websites without revealing your actual location to potential scammers.

FAQs

Cash App is a legitimate mobile payment application developed by Square Inc. It is not inherently a scam, but scammers can use Cash App for fraudulent activities, so users should exercise caution and follow security best practices.

No, there have been no reports of the Cash App being hacked in June 2023. However, the company that owns the Cash App did report a data breach in 2022, but that wasn’t a big deal either.

Scammers may send you money as part of a scam to create a false sense of trust or urgency. They may later ask you to send the money back or share sensitive information, exploiting your willingness to return the funds.

Cash App is owned by Block Inc., formerly Square Inc., a financial services and mobile payment company founded by Jack Dorsey and Jim McKelvey in 2009.

Cash App and PayPal have security measures in place, but the safety of your transactions also depends on your actions and how you use these services.

Cash App may collect location information for certain purposes, such as fraud prevention and compliance with local laws.

No, the rumors about the Cash App going bankrupt are false, and the online payment service isn’t closing, and there are no indications that say otherwise.

No comments were posted yet